Best Truck Loans for 2025 and 2026: Rates, Banks & Online Lenders

Truck loans 2025 and 2026 are becoming some of the most competitive financing products in the U.S. auto market, offering buyers access to the best rates, top lenders, instant approval options and flexible terms. Whether you’re looking for a new or used pickup truck, or need commercial financing, understanding how these truck loans work in 2025 and 2026 can save you thousands of dollars. This guide breaks down the best lenders, online approval processes, requirements, rates, and practical tips to help you secure the right loan fast.

What a Truck Loan Is and How It Works

A truck loan is a type of auto financing designed for purchasing new, used, or commercial trucks, including diesel, heavy-duty and high-performance pickups. It works similarly to a traditional auto loan but with a few key differences:

- The truck itself is used as collateral (secured loan).

- Your interest rate depends on credit score, income, down payment and lender.

- Loan terms usually range from 36 to 84 months.

- Financing may come from banks, credit unions, or online lenders.

The goal is simple: allow buyers to pay monthly installments with low interest rates and flexible terms. In 2025 and 2026, more consumers are turning to online applications, many offering instant approval and streamlined processes, including options for people without established U.S. credit.

Top Benefits of Truck Loans 2025 and 2026

1. Best Rates for New and Used Trucks

With more lenders competing, interest rates have become more attractive — especially online.

2. High Approval Odds

Programs are available for borrowers with excellent credit, average credit, and bad credit.

3. Zero Down Payment Options

Some lenders offer zero down, mainly for new trucks or manufacturer-financed vehicles.

4. Fast and Fully Online Applications

Digital lenders offer same day approval or instant approval in many cases.

5. Flexible Terms

Borrowers can choose terms from 3 to 7 years to fit their monthly budget.

6. Large Variety of Lenders

Competition includes banks, credit unions, fintechs, and specialized truck lenders.

Who Can Apply for a Truck Loan

You can apply for a truck loan in the U.S. if you:

- Are 18 or older

- Have a Social Security Number or ITIN

- Can provide proof of income

- Have an active bank account

- Have a stable U.S. address

The good news: you don’t need perfect credit. Many lenders provide solutions for bad credit, thin credit file, newcomers to the U.S., and even no credit check lenders (with higher interest rates).

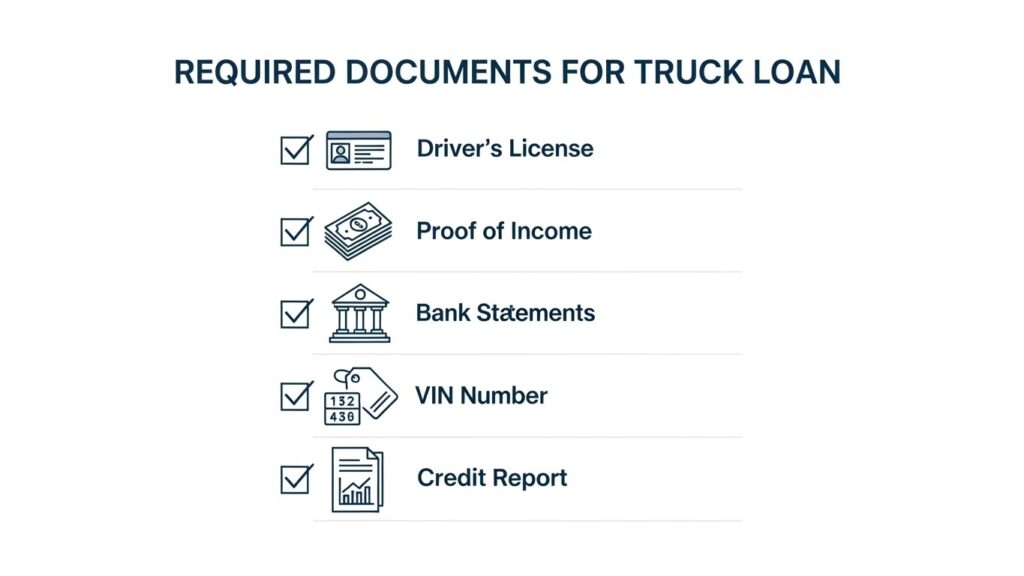

Required Documents for High Approval Rates

Personal Documents

- SSN or ITIN

- Driver’s License

- Proof of address (utility bill, lease, etc.)

Proof of Income

- Pay stubs from the last 30 days

- Bank statements from the last 3 months

- W-2 or tax return (for self-employed)

Vehicle Information

- VIN

- Mileage

- Year and model

- Dealer details

Credit Documentation

- Updated credit report

- Explanation letter if you have bad credit or derogatory marks

Having everything prepared significantly increases chances of same day approval.

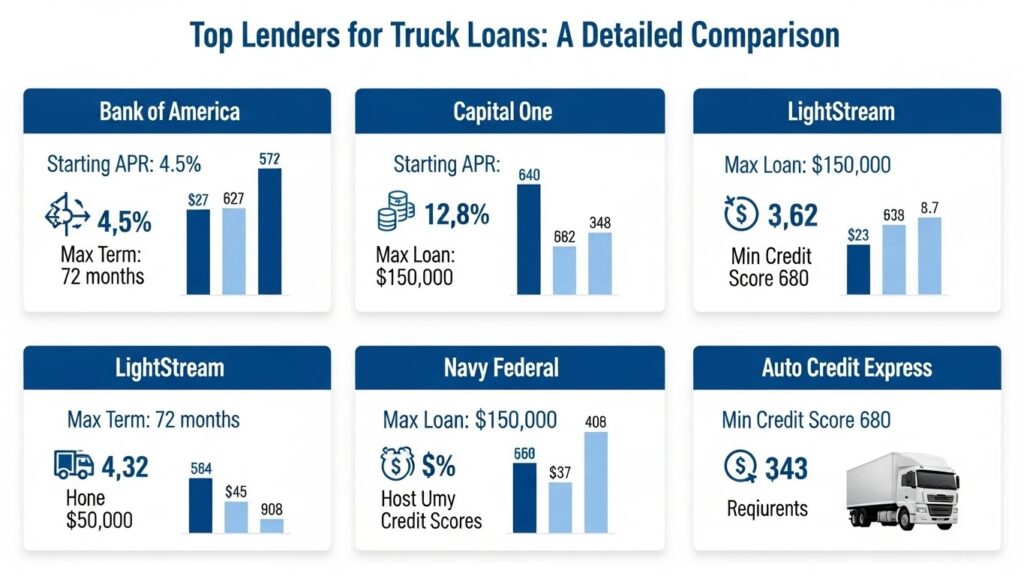

Best Banks and Online Lenders for Truck Loans (2025–2026)

Below are the top lenders offering best rates, high approval, and competitive programs.

1. Bank of America – Best Overall Rates

- Rates starting at 5.9% APR

- Online application + fast preapproval

- Excellent low interest option

- Discounts for existing customers

2. Capital One Auto Navigator – Best for Preapproval

- Easy rate comparison

- Accepts borrowers with fair credit

- 100% online process

- High approval percentages

3. Navy Federal Credit Union – Best for Military

- Very competitive APR

- Easy approval

- Exclusive for military members and families

4. LightStream – Best for Excellent Credit

- Same day funding

- Market-leading low rates

- Great for new, used, and commercial trucks

5. Carvana / Vroom – Best Fully Online Experience

- Completely digital process

- Options for bad credit

- Instant approval on certified trucks

6. Auto Credit Express – Best for Bad Credit

- Specializes in low credit borrowers

- Matches applicants with high approval lenders

7. Ford Credit / GM Financial – Best Zero Down Programs

- Ideal for F-150, F-250, Silverado, GMC models

- Promotional zero down and low interest incentives

Lender Comparison Overview

| Lender | Best For | Rates | Key Advantages |

|---|---|---|---|

| Bank of America | Overall | Low | Strong preapproval |

| Capital One | Easy preapproval | Varies | Intuitive platform |

| LightStream | Excellent credit | Very low | Same day funding |

| Navy Federal | Military | Low | High approval |

| Auto Credit Express | Bad credit | Higher | Specialized matching |

| Ford/GM | New trucks | Promotional | Zero down |

Truck Loan Rates, Terms and Interest (2025–2026)

Average truck loan APR in 2025 is estimated between 5.9% and 12.9%, depending on borrower profile. In 2026, trends show slight interest rate relief as inflation cools.

Estimated APR Ranges:

- Excellent credit (720+): 5.9% – 7.4%

- Good credit (680–719): 7.5% – 9.9%

- Fair credit (620–679): 10% – 14.5%

- Bad credit (<620): 15.9% – 29%

Typical Terms

- 36 months

- 48 months

- 60 months

- 72 months

- 84 months (primarily new trucks)

Longer terms reduce monthly payments but increase total loan cost.

Practical Tips for Fast Approval

1. Get Preapproved by 2–3 Lenders

Strengthens negotiation power and often lowers rates.

2. Have All Documents Ready

This accelerates underwriting and boosts same day approval chances.

3. Consider a Down Payment

Even small down payments help reduce APR.

4. Avoid Hard Pulls from Too Many Lenders

Use soft pull tools before applying officially.

5. Compare Online Lenders

They frequently offer best rates and more flexible approvals.

6. Improve Credit Before Applying

Pay small debts, lower credit utilization and update your credit report.

FAQ – Frequently Asked Questions

1. Can I get a truck loan with bad credit?

Yes. Many lenders offer high approval programs for low credit scores.

2. Are zero down truck loans available?

Yes. Manufacturers like Ford and GM often run zero down promotions.

3. Are online lenders safe?

Yes — if they are licensed and reputable. Many top lenders now operate online-only.

4. How much can I finance?

It depends on your income and credit, but some lenders offer up to 130% financing.

5. Can I apply using an ITIN?

Some lenders accept ITIN applications, especially credit unions and online lenders.

6. How long does approval take?

It may be instant approval, a few hours, or one business day.

Finding the best truck loans for 2025 and 2026 depends on comparing lenders, checking updated rates, and choosing institutions with best rates, fast processes, and high approval odds. If you want to save money, avoid high APRs and secure the perfect truck, keep exploring our website for full comparisons of top lenders, interest rates, and loan options for every credit profile.

👉 Compare the best lenders now and find the perfect truck loan for your budget.