Car financing in the United States involves far more than applying for a loan and signing a contract. Car financing decisions are shaped by hidden lender strategies, internal scoring models, and dealership markups that influence your APR, approval odds, and monthly payment. Understanding these secrets can help you secure the best rates, increase your chances of high approval, and avoid thousands of dollars in unnecessary costs.

This guide reveals the 7 biggest secrets banks don’t tell U.S. borrowers and provides a full breakdown of how car financing works, who qualifies, required documents, top lenders, interest rates, and smart strategies to get instant approval, even if you have bad credit.

What Car Financing Is and How It Works

Car financing is a lending process in which a bank, credit union, manufacturer lender, or online lender provides funds to purchase a vehicle. The borrower repays the money over time, usually between 36 and 84 months, with interest.

How Car Financing Works Step-by-Step

- Application submitted — online, in person, or at a dealership.

- Lender reviews your profile — credit score, internal risk tier, income, ZIP Code, and loan amount.

- Loan offer generated — includes APR, loan term, and total financed amount.

- Dealer may adjust your rate using the dealer markup (hidden and legal).

- Contract signed — lender pays the dealership.

- You begin repayment — interest accrues daily in simple interest loans.

Car financing can be straightforward, but lenders rarely explain what actually influences your rate and approval odds.

The 7 Secrets Banks Hide About Car Financing

1. Lenders Use Internal Risk Tiers That Matter More Than Your Credit Score

Most borrowers believe their FICO score determines everything. But banks rely heavily on internal risk tiers — hidden scoring systems that analyze:

- Employment stability

- Length at current address

- Debt-to-income ratio

- Banking history

- Car type (new, used, mileage, model year)

- Monthly payment relative to income

This means:

- A borrower with a 650 score but strong income stability may get better rates than someone with a 720 score but high revolving debt.

- Approval odds depend on lender-specific formulas you never see.

Banks do not disclose these internal models because they heavily impact pricing and risk decisions.

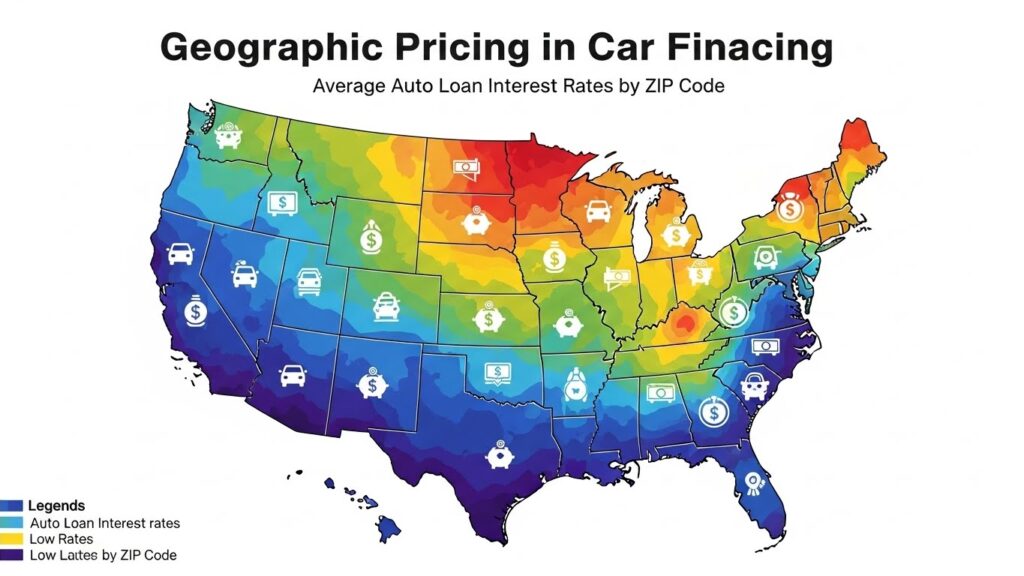

2. Your ZIP Code Can Change Your Monthly Payment by $50–$80

Many borrowers are shocked to learn that car financing APRs vary by ZIP Code.

Lenders analyze geographic risk, including:

- Local debt default rates

- Unemployment levels

- Vehicle theft and repossession data

- Economic volatility

Two applicants with identical profiles can receive dramatically different APRs simply because they live in different ZIP Codes. Over a 72-month loan, this difference may exceed $3,000.

Banks rarely reveal the geographic pricing formula behind these decisions.

3. The Best Time to Apply Is When Dealers Need to Hit Sales Targets

Banks approve more borderline applicants when:

- Dealers are approaching monthly quota

- Manufacturers offer incentive programs

- End-of-quarter deadlines approach

- Weekend sales volume is high

During these periods, lenders loosen underwriting to help dealers close more deals. This can drastically improve your chances of high approval, especially for borrowers with bad credit.

Borrowers who apply on “slow days” often receive stricter evaluations — another hidden factor banks don’t clarify.

4. Dealer Markup Can Double Your APR Without You Knowing

When a lender gives a dealership a buy rate — the actual APR approved — the dealer is legally allowed to increase it by 2% to 4% (sometimes more). This is the dealer markup, a major source of profit.

Example:

- Lender approves you at 5.9%

- Dealer marks it up to 9.9%

- The extra 4% goes to the dealership, not the bank

To protect yourself, always ask:

“What is the lender’s buy rate on my application?”

Most borrowers never do, and dealers rely on that silence.

5. Refinancing After 90 Days Can Reduce Your APR by 30%

Banks never advertise this because refinancing early destroys their projected interest revenue.

After 90 days of on-time payments:

- Your internal risk tier improves

- Your credit score updates

- Online lenders offer instant approval and low interest refinancing

- You qualify for same day funding

Borrowers with improving credit can cut thousands in interest by refinancing quickly.

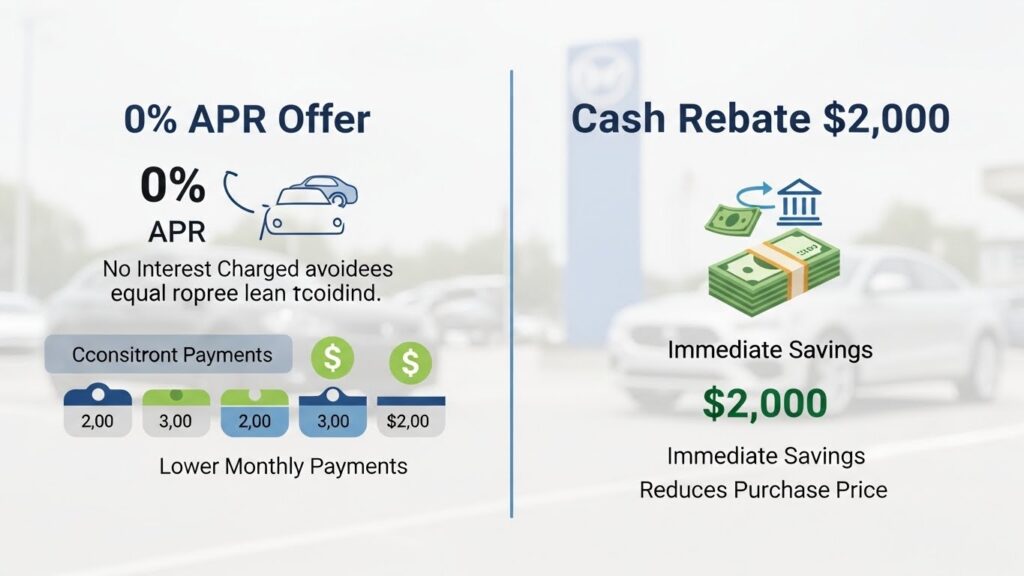

6. 0% APR Isn’t Really a Deal — You Sacrifice Thousands in Incentives

Automakers promote zero down and 0% APR financing, but what they rarely mention is the trade-off:

To qualify for 0% APR, you must give up:

- Cash rebates

- Dealer discounts

- Inventory incentives

- Trade-in bonuses

These incentives often total $1,500–$3,500.

In many cases, financing at 3.9% with rebates is cheaper than accepting 0% APR with no incentives.

7. An Early Payment Strategy Can Save You Over $3,200

Because car financing in the U.S. uses simple interest, you can reduce total interest by:

- Making one extra payment per year

- Adding $50–$80 to your monthly payment

- Switching to biweekly payments

This shortens your loan term and cuts interest dramatically — but banks never mention it because it reduces their profit margin.

Benefits of Car Financing

Car financing offers several advantages:

Accessibility

Borrowers can choose top lenders, online lenders, and local banks all competing to offer best rates.

Builds credit

On-time payments strengthen your credit profile, helping with future loans.

Flexible terms

36–84 months, with options tailored to income and budget.

Instant approval options

Many online lenders provide same day or instant approval, ideal for urgent purchases.

Low interest opportunities

Borrowers with strong credit can access extremely competitive rates.

Who Can Apply for Car Financing?

Car financing is available to:

- U.S. citizens

- Permanent residents

- Immigrants with ITIN

- Students with co-signers

- Borrowers with bad credit

- Self-employed workers using bank statements

Modern lenders use AI-driven analysis to provide high approval odds even for nontraditional borrowers.

Car Financing Requirements and Necessary Documents

Basic Requirements

- 18+ years old

- Verifiable income

- Valid driver’s license

- U.S. address

Required Documents

- ID (driver’s license or passport)

- SSN or ITIN

- Pay stubs or bank statements

- Proof of insurance

- Proof of residence

- Vehicle details (VIN, mileage, condition)

Some online lenders specializing in no credit check loans require fewer documents.

Top Lenders for Car Financing in the U.S.

Capital One Auto Finance

Great for bad credit borrowers and quick prequalification.

Bank of America

Strong low interest rates, especially for existing customers.

Chase Auto

Ideal for new car purchases and partnerships with major manufacturers.

LightStream

Best for excellent credit; extremely low interest and no fees.

Navy Federal Credit Union

High approval odds for military families.

AutoPay & RefiJet

Specialists in refinancing with best rates.

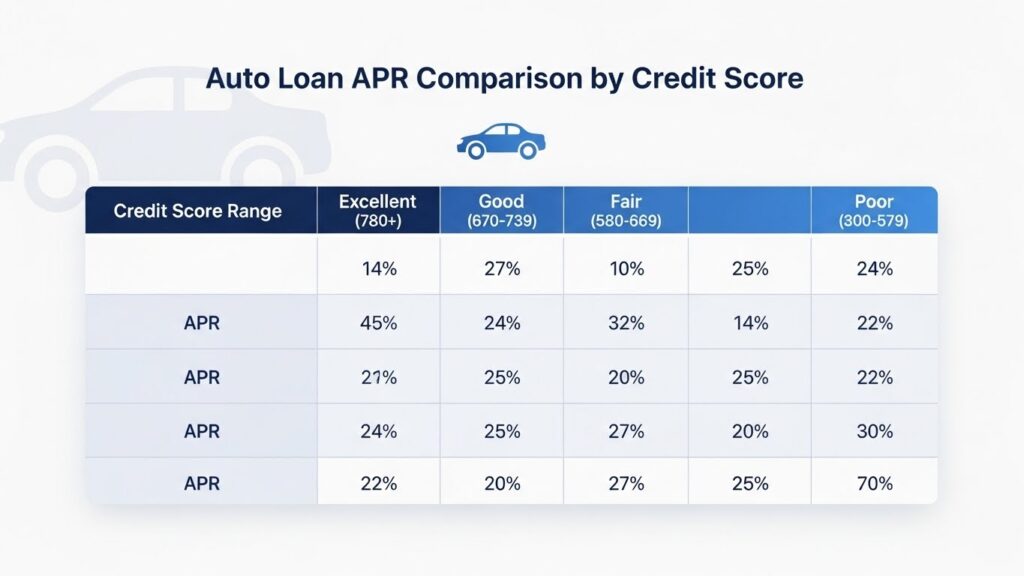

Car Financing Rates, Terms, and Total Costs

| Credit Tier | New Car APR | Used Car APR |

|---|---|---|

| Excellent (781+) | 4.7% | 5.3% |

| Good (661–780) | 6.5% | 8.4% |

| Fair (601–660) | 10.5% | 15.6% |

| Poor (501–600) | 14.8% | 20.9% |

| Bad Credit (≤500) | 20%+ | 25%+ |

Loan terms range from 36 to 84 months, depending on income and credit.

Practical Tips to Get Fast Approval and Lower Rates

1. Apply with online lenders first

Avoid dealer markup and get instant approval options.

2. Boost your credit 30 days before applying

Lower utilization, fix errors, remove disputes.

3. Compare at least three lenders

Competition leads to best rates.

4. Keep loan terms shorter

Shorter terms = lower total interest.

5. Avoid expensive add-ons

Warranty markups inflate the financed amount and your APR.

6. Refinance after 90 days

Improving credit equals lower rates.

FAQ: Car Financing Explained

Can I get car financing with bad credit?

Yes. Many online lenders offer high approval and bad credit options.

Does car financing require a down payment?

Some lenders offer zero down, depending on credit and income.

Do online lenders offer same day approvals?

Yes, especially for refinancing and used car purchases.

Can ITIN holders apply?

Yes. Many lenders accept ITIN borrowers with proof of income.

Is 0% APR worth it?

Not always. You usually sacrifice valuable rebates.

Compare Lenders Before You Sign Anything

Banks and dealerships rarely explain the real factors behind car financing decisions. Now that you know the 7 hidden secrets, you can negotiate better, avoid hidden markups, and secure the best rates no matter your credit situation.

To continue, compare lenders, explore refinancing, or check today’s top online lenders to get the best offer for your situation.