What Is Automotive Financing?

Automotive financing refers to the process of borrowing money to purchase a vehicle. Instead of paying the full price upfront, buyers can secure a car loan from a bank, credit union, or dealership and repay it in monthly installments. This makes owning a vehicle more accessible while allowing buyers to build or improve their credit history.

Whether you’re buying your first car or upgrading to a newer model, understanding how automotive financing works can help you save thousands of dollars over the life of your loan.

How Does Automotive Financing Work?

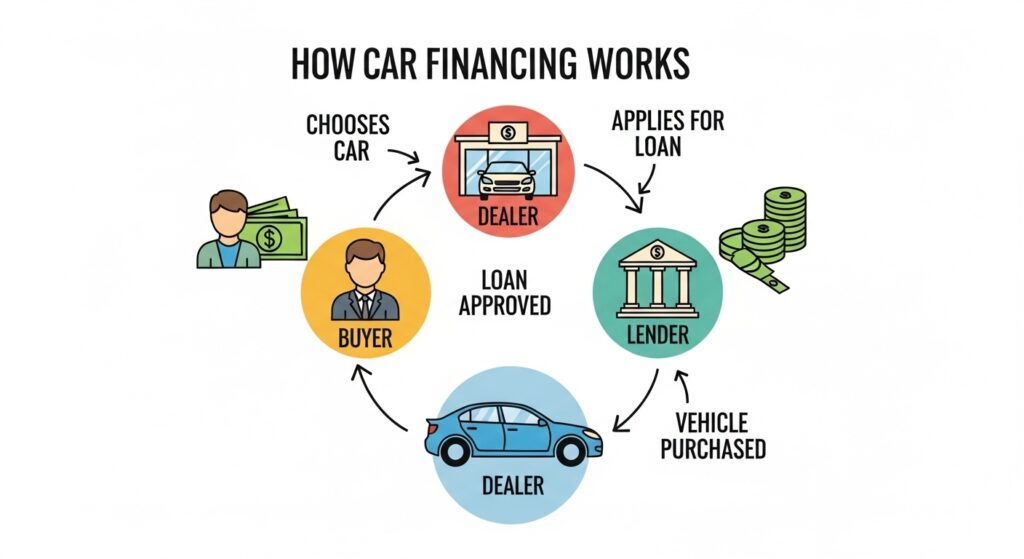

When you finance a car, the lender pays the dealer the total cost of the vehicle. You, as the borrower, then agree to pay the lender back over a fixed period—usually between 36 and 72 months—with added interest.

Your loan amount, interest rate, and monthly payment depend on several factors:

- Your credit score

- The loan term (length of repayment)

- The down payment

- The type and age of the vehicle

- The lender’s policies

The key to smart automotive financing is understanding how these elements affect your total cost.

Types of Automotive Financing

There are several options when it comes to financing your vehicle:

1. Dealership Financing

Most dealerships offer in-house financing through their network of lenders. It’s convenient, but not always the cheapest option—dealers often add a markup to the interest rate.

2. Bank or Credit Union Loans

Banks and credit unions typically offer better interest rates than dealerships. If you have an existing relationship or good credit, you may qualify for lower APRs and more flexible terms.

3. Online Auto Lenders

Online lenders provide fast approvals and allow you to compare multiple offers. This is ideal for buyers looking for transparency and competitive rates.

4. Leasing Options

Instead of buying, leasing allows you to drive a new car for a few years and return it afterward. It’s perfect for those who like upgrading frequently and prefer lower monthly payments.

How to Qualify for Automotive Financing

To qualify for a car loan, lenders typically look at:

- Credit score (FICO 600+)

- Income verification

- Debt-to-income ratio

- Employment stability

If you’re a first-time buyer or have limited credit, you can still get approved by:

- Making a larger down payment

- Using a co-signer

- Exploring subprime auto lenders

- Building credit with a secured credit card

Tips for Getting the Best Car Loan

- Check Your Credit Report: Ensure there are no errors before applying.

- Shop Around: Compare offers from banks, credit unions, and online lenders.

- Negotiate the Interest Rate: Don’t accept the first offer.

- Avoid Long Loan Terms: 72+ month loans may seem appealing but cost more in interest.

- Get Pre-Approved: It gives you bargaining power at the dealership.

Refinancing an Auto Loan

If your credit score improves or interest rates drop, you can refinance your existing auto loan to secure a better rate and more favorable terms. Refinancing essentially means replacing your current loan with a new one—often through a different lender—that offers a lower interest rate or a more manageable repayment plan.

By doing this, you can reduce your monthly payments, free up extra cash in your budget, and save hundreds or even thousands of dollars over the life of the loan. Additionally, refinancing can help you adjust your loan duration; you might choose a shorter term to pay off your car faster or a longer term to ease financial pressure.

It’s important to review your credit profile, current loan balance, and market interest rates before refinancing to ensure it’s truly beneficial. A few points’ improvement in your credit score can make a significant difference in the rate lenders offer, helping you build stronger financial stability over time.

Automotive Financing for Immigrants and Students

Many immigrants and international students in the U.S. can also qualify for automotive financing, even without a Social Security Number (SSN). Instead, they can use an ITIN (Individual Taxpayer Identification Number), which serves as an alternative form of identification for tax and financial purposes.

Today, several specialized lenders and financial institutions understand the unique challenges newcomers face when trying to buy a car in the United States. These lenders offer tailored loan programs that make it possible to purchase a vehicle, build a positive credit history, and gain financial independence sooner.

By obtaining an auto loan with an ITIN, immigrants and students can begin establishing U.S. credit, which is essential for future opportunities such as renting an apartment, applying for credit cards, or securing a mortgage. This type of financing not only provides mobility but also helps lay the foundation for long-term financial growth and stability in the U.S.

Final Thoughts

Automotive financing gives you the flexibility to own a car without depleting your savings, allowing you to enjoy the benefits of vehicle ownership while spreading the cost over manageable monthly payments. This makes it easier to balance your finances, especially if you’re also managing other expenses such as rent, education, or family costs.

However, it’s essential to understand the loan terms, including interest rates, repayment periods, and any hidden fees. Taking the time to research and compare lenders can make a significant difference—sometimes saving you thousands of dollars over the life of the loan.

Before signing any agreement, make sure to review your credit score, as it directly affects the interest rate you’ll receive. A higher score can unlock better financing offers and lower payments.

By approaching the process with preparation and awareness, you can plan your budget responsibly, avoid financial stress, and drive away confident that you’ve made the smartest financial decision for your situation.