Best Personal Loans for Bad Credit

Best Personal Loans for Bad Credit are not hard to find when you know which lenders offer high approval, low interest options, and fast funding even with a low credit score.

Here’s the good news: millions of Americans get approved every year, even with low credit scores, thin credit history, late payments, or recent financial challenges.

Thanks to the rise of online lenders, it’s now possible to get:

- Instant approval

- Same day funding

- Low-interest options

- Zero down

- High approval rates

- Flexible requirements

This complete guide explains how bad credit loans work, who approves more easily, which lenders offer the best rates, and the practical strategies you can use to increase your approval chances immediately.

Best Personal Loans for Bad Credit: What They Are and How They Work

A bad credit personal loan is a type of unsecured loan available to borrowers with a low FICO score (usually below 580).

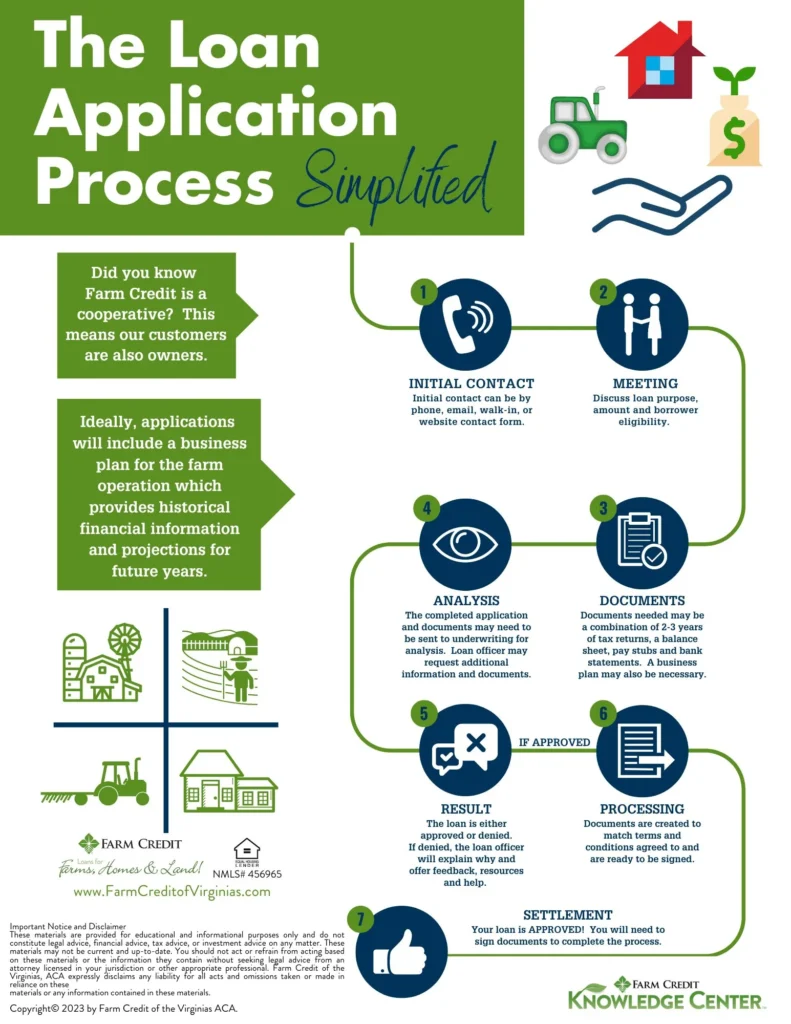

Here’s how it works:

- You apply online

- The lender evaluates your credit and income

- If approved, the funds are deposited directly into your bank account

- You repay the loan in fixed monthly payments

- Terms range from 12 to 60 months

Many lenders offer soft credit checks, meaning your score is not affected until the final approval stage.

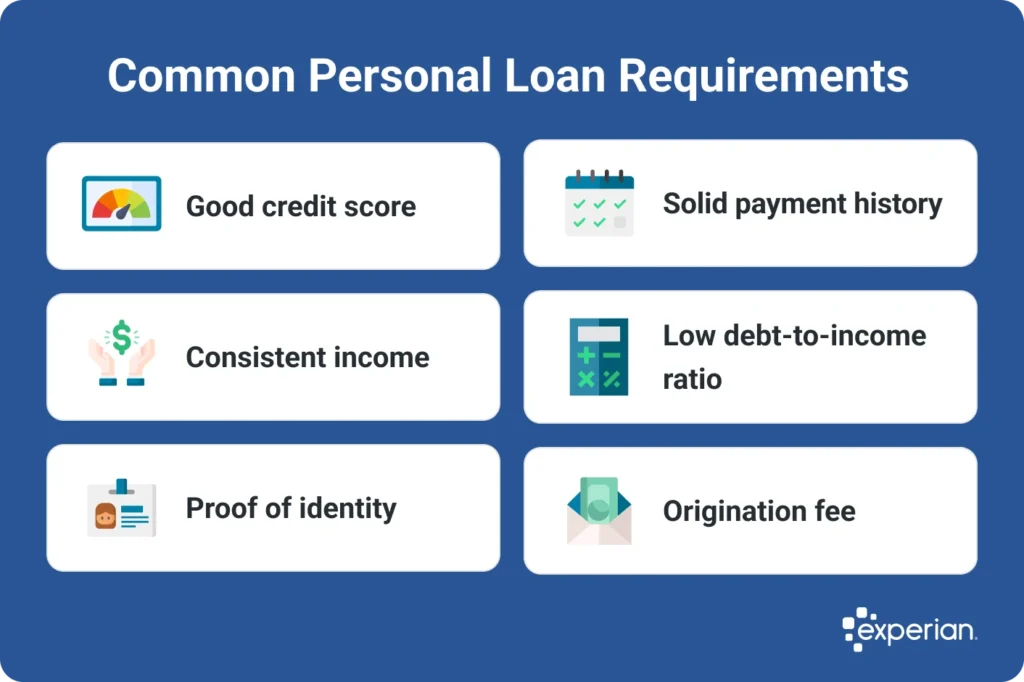

For bad credit borrowers, lenders look at:

- Stable bank account activity

- Verifiable income

- Low debt-to-income ratio

- Active checking account

Benefits of Personal Loans for Bad Credit

Flexible Use of Funds

You can use the money for:

- Emergencies

- Debt consolidation

- Medical bills

- Auto repair

- Moving expenses

- Small home improvements

- Daily expenses

Fast Approval and Same Day Funding

Many online lenders release funds in a few hours.

Fixed Monthly Payments

Predictable payments make budgeting easier.

No Collateral Required

Most loans are unsecured — perfect if you don’t want to risk your car or home.

Who Can Apply

Even with poor credit, you can apply as long as you have:

- An active US bank account

- Regular income

- Valid ID

- Age 18 or older

- At least 2–3 months of financial stability

These loans are ideal for people with:

- Credit scores under 600

- Limited credit history

- Past late payments

- High credit utilization

- Recent financial struggles

Online lenders often offer higher approval rates than traditional banks.

Requirements and Documents Needed

Basic Requirements

- US residency

- Social Security Number or ITIN

- Verifiable income

- Active checking account

- Smartphone or computer to apply

Required Documents

- Pay stubs or bank statements

- Driver’s license or State ID

- Proof of address

- Employer details

- Bank account information for deposit

Best Banks and Online Lenders for Bad Credit

1. Navy Federal Credit Union

Excellent if you’re military, a veteran, or a qualifying family member.

- APR starting at 8.99%

- No origination fees

- High approval rates for bad credit

- Same day funding available

2. Upgrade

- High approval rates

- Ideal for credit scores 560–640

- Same day deposit available

3. Upstart

Uses AI to evaluate more than just your credit score.

- Great for thin credit files

- Fast approvals

- Competitive APR

4. OneMain Financial

- Accepts very low credit scores

- In-person service available

- Flexible loan terms

5. Avant

- One of the best for bad credit borrowers

- Best rates for scores 550–600

- Quick and straightforward process

6. OppLoans

- Designed for borrowers with very challenged credit

- Weekly or monthly payments

- Fast approvals

7. LendingClub

- Great for comparing multiple offers

- Strong reputation

- Funding in 24–48 hours

Relevant Comparisons

Banks vs Online Lenders

| Category | Banks | Online Lenders |

|---|---|---|

| Bad credit approval | Low | High |

| Speed | Slow | Same day |

| Requirements | Strict | Flexible |

| Interest rates | Lower but hard to qualify | Variable |

| Convenience | Medium | Excellent |

Secured vs Unsecured Loans

- Secured: Lower interest, collateral required

- Unsecured: Faster approval, ideal for emergencies

Credit Unions vs Fintechs

- Credit unions: Better rates

- Fintechs: Higher approval chances

Rates, Fees and Terms

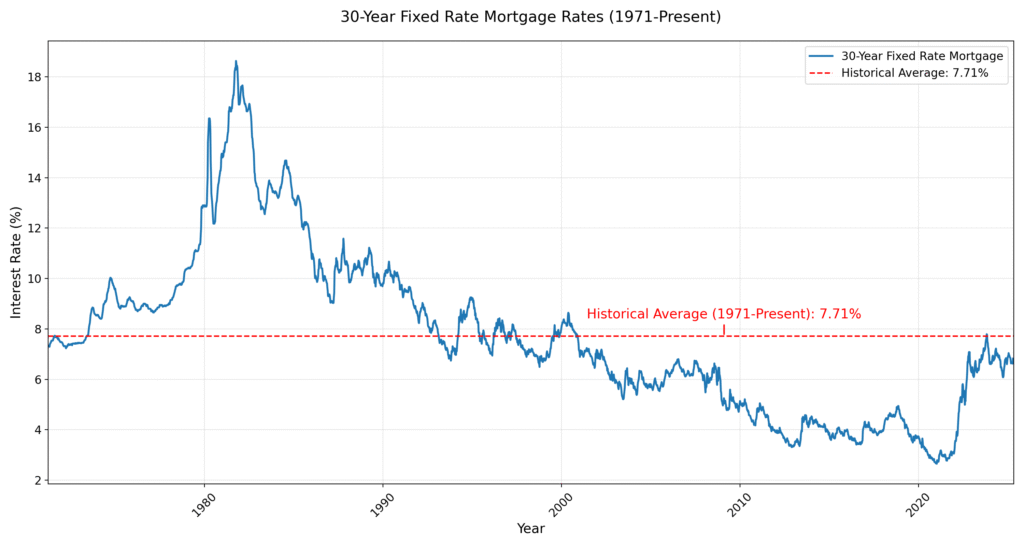

Interest Rates

Bad credit borrowers typically see:

- 8.99% to 35.99% APR

The lower your credit score, the higher the rate.

Origination Fees

- Between 0% and 12%

- Many online lenders charge this fee due to increased risk

Loan Terms

- 12 to 60 months

- Some lenders offer up to 84 months

Late Fees

- Charged if payments are missed

- Always check terms before accepting

Practical Tips for Fast Approval

1. Check Your Credit Report

Correcting errors can increase your score almost instantly.

2. Apply With a Co-Signer

Better chances + lower interest rates.

3. Compare Lenders Before Applying

Pre-qualify with multiple lenders.

4. Choose Soft Pull Lenders

Avoid hard inquiries during the early stages.

5. Show Stable Income

Strong bank statements improve approval chances.

6. Consider Secured Loans

Using collateral lowers risk and reduces APR.

7. Lower Your Debt-to-Income Ratio

Aim to keep DTI under 40% for best results.

FAQ — Best Personal Loans for Bad Credit

Can I get a personal loan with a 500 credit score?

Yes. Lenders like OneMain and OppLoans often approve low scores.

Is same day funding possible?

Upgrade, Upstart, and Avant frequently release funds on the same day.

What is the minimum income required?

Many lenders approve applications starting at $1,200–$1,500 per month.

Does applying hurt my credit?

Soft checks don’t affect your score. Hard enquiries appear only at final approval.

Are there no credit check options?

Some lenders offer pre-approval without a hard pull.

Compare the Best Personal Loans for Bad Credit Today

Finding the best personal loans for bad credit doesn’t have to be complicated.

Today, dozens of banks, credit unions, and fintech lenders offer:

- flexible terms

- fast approvals

- competitive rates

- same day or next day funding