Find the Best Personal Loans for Bad Credit in 2026. Compare top lenders, get instant approval, same-day funding, and the best rates available online.

How to Get Approved for a Personal Loan With Bad Credit in 2026

Getting approved for a personal loan with bad credit used to feel nearly impossible. Traditional banks focused almost exclusively on credit scores, leaving millions of Americans without realistic financing options. In 2026, that reality has changed dramatically.

Today’s lending market is driven by online lenders, fintech platforms, and alternative underwriting models that look beyond your FICO score. Income stability, employment history, banking behavior, and repayment capacity now play a much larger role in approval decisions.

This guide to the Best Personal Loans for Bad Credit in 2026 is built to help you compare top lenders, understand rates and requirements, secure instant approval, and access same-day funding—even if your credit score is low.

What Are Personal Loans for Bad Credit and How Do They Work?

Definition and Purpose

A personal loan for bad credit is an installment loan designed for borrowers with credit scores typically below 620. These loans are most commonly unsecured, meaning no collateral is required, and they come with fixed interest rates and predictable monthly payments.

Unlike payday loans or cash advances, legitimate personal loans offer transparent terms and structured repayment, making them safer and more sustainable.

How the Process Works in 2026

- Online application (5–10 minutes)

- Soft credit check for prequalification

- Instant approval decision

- Income and identity verification

- Same-day or next-day funding

Many lenders now use AI-driven underwriting, increasing high approval odds even for borrowers with poor or limited credit histories.

Benefits of Personal Loans for Bad Credit

Personal loans tailored for bad credit borrowers provide several key advantages:

- High approval rates compared to traditional banks

- Fast funding, often same day

- Fixed interest rates and terms

- Zero down payment on unsecured loans

- Access to reputable online lenders

- Opportunity to rebuild credit with on-time payments

For many borrowers, these loans are a smarter alternative to high-interest credit cards or predatory short-term loans.

Who Can Apply for a Bad Credit Personal Loan?

Most lenders in 2026 approve applicants who meet the following criteria:

- U.S. citizen or legal resident

- At least 18 years old

- Verifiable income (employment, self-employment, benefits, or retirement)

- Active checking account

- Stable monthly cash flow

Even borrowers with past bankruptcies, collections, or late payments may qualify if current income and debt levels are reasonable.

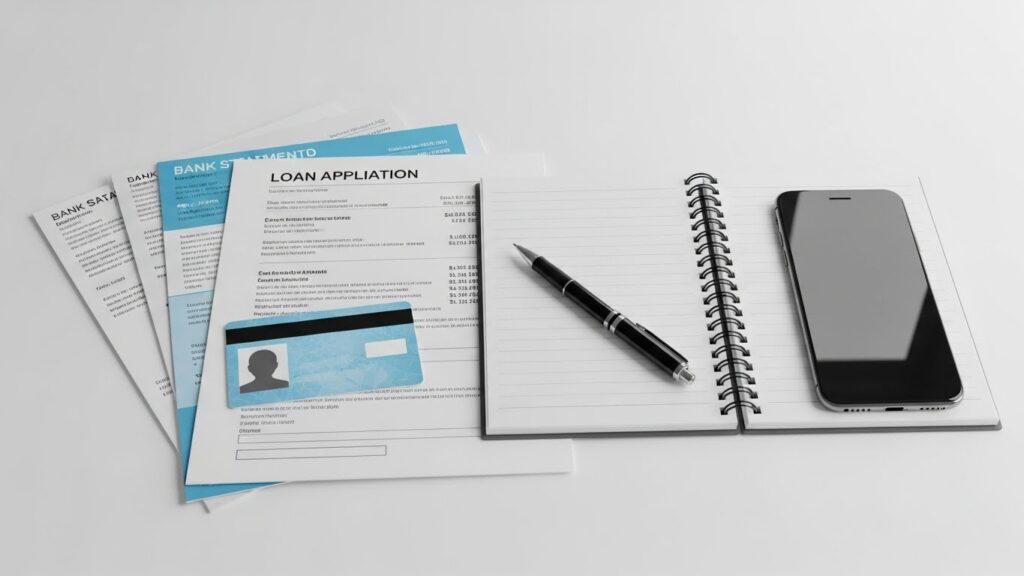

Requirements and Documents Needed

Basic Eligibility Requirements

- Minimum monthly income (varies by lender)

- Acceptable debt-to-income (DTI) ratio

- Active U.S. bank account

- Valid identification

Common Documents Requested

- Government-issued ID

- Proof of address

- Pay stubs or bank statements

- Tax returns (self-employed applicants)

Some lenders advertising no credit check loans still verify income and banking activity rather than relying on credit bureaus.

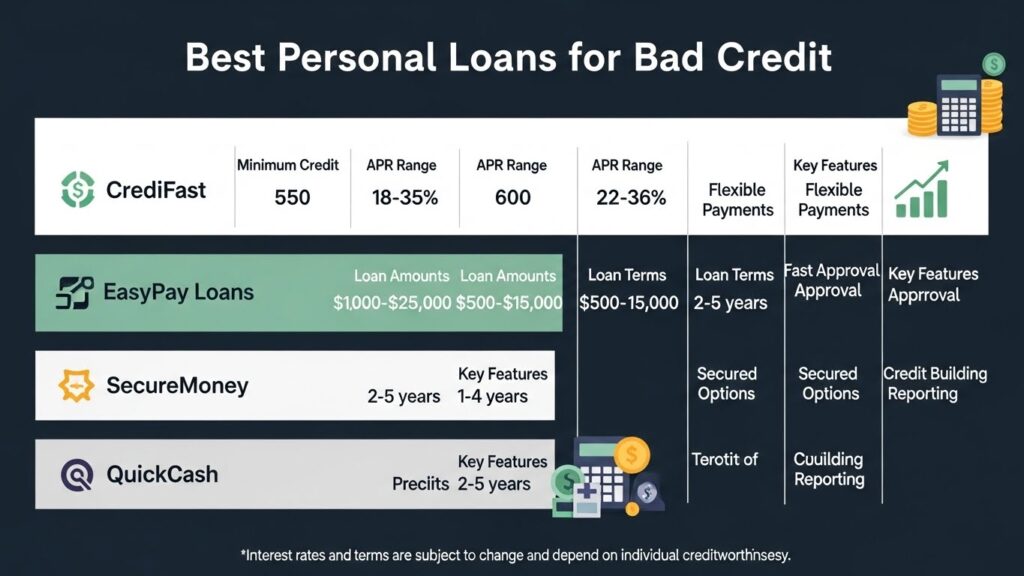

Best Banks and Online Lenders for Bad Credit in 2026

Online Installment Lenders (Highest Approval Odds)

These lenders specialize in bad credit borrowers and offer:

- Instant approval

- Same-day funding

- Fully digital applications

They are ideal for borrowers seeking speed and convenience.

Lending Marketplaces (Best for Comparing Rates)

Marketplace platforms match your profile with multiple top lenders using one soft credit check, allowing you to compare best rates efficiently.

Credit Unions (Lower Interest, Slower Funding)

Credit unions may offer low interest rates for members but often require longer approval timelines.

Secured Loan Providers

Using collateral may reduce interest rates but increases risk. Only recommended if unsecured options are unavailable.

Loan Comparison: What to Choose and What to Avoid

| Loan Type | Interest Rates | Risk Level | Recommendation |

|---|---|---|---|

| Unsecured Personal Loans | Moderate | Medium | Best overall option |

| Secured Loans | Low | High | Only if necessary |

| Payday / Title Loans | Extremely High | Very High | Avoid completely |

⚠️ Important: Loans marketed as “no credit check” often come with excessive APRs and short repayment terms. Always prioritize fixed-rate installment loans from reputable lenders.

Rates, Interest, and Loan Terms in 2026

Typical APR Ranges

- 18% to 35.99% for bad credit borrowers

Fees to Consider

- Origination fees (1%–8%)

- Late payment penalties

- Returned payment fees

Loan Terms

- 24 to 60 months

- Longer terms lower monthly payments but increase total cost

Always compare APR, not just the monthly payment.

Practical Tips to Get Approved Faster

- Use prequalification tools with soft credit checks

- Apply with online lenders first

- Keep loan amounts realistic

- Reduce outstanding debt before applying

- Ensure accurate income documentation

- Consider a co-signer for better rates

These steps significantly improve high approval chances and access to best rates.

Frequently Asked Questions (FAQ)

Can I get approved with a credit score below 600?

Yes. Many lenders approve borrowers with scores as low as 550 based on income and stability.

Are same-day personal loans real?

Yes. Many online lenders offer same-day funding after approval.

Do bad credit loans help rebuild credit?

Absolutely. On-time payments are reported to credit bureaus and improve your score over time.

Are personal loans zero down?

Yes. Most unsecured personal loans require zero down payment.

Will checking rates hurt my credit?

Prequalification uses soft inquiries and does not impact your credit score.

Compare Lenders and Take Control Today

The Best Personal Loans for Bad Credit in 2026 are no longer limited to last-resort options. With modern underwriting, trusted online lenders, and transparent loan structures, borrowers with poor credit now have real opportunities to secure funding responsibly.

The smartest move is to compare multiple pre-approved offers, analyze total costs, and choose the lender that best fits your financial situation.