7 Banks That Approve a New LLC are the fastest path for entrepreneurs who want to access up to $50,000 in business credit without proof of income or revenue.

7 Banks That Approve a New LLC for Business Credit

Securing business funding in the United States is one of the biggest challenges for new entrepreneurs—especially those who just formed an LLC and have no revenue yet. Most business owners believe they must first generate income before applying for credit. In reality, the opposite is true.

Banks approve business credit more easily when you don’t urgently need it.

In this guide, you’ll discover 7 banks that approve a brand-new LLC for up to $50,000, often with 0% introductory APR, no proof of income, and high approval odds, even if your business was formed yesterday.

These are real banks and top lenders—not Net-30 vendors or store cards—offering legitimate business credit cards that can be used for payroll, contractors, marketing, ads, inventory, and operating expenses.

What Is Business Funding for a New LLC and How It Works

Many entrepreneurs search for 7 Banks That Approve a New LLC because traditional lenders often require revenue history, tax returns, or collateral — requirements that most startups simply don’t have.

Business funding for a new LLC typically comes in the form of business credit cards or lines of credit issued based on the owner’s personal credit profile, not business revenue.

This is known as personally guaranteed business credit.

How It Works in Practice

- You form an LLC and obtain an EIN

- You apply for business credit using your SSN or EIN

- The bank evaluates personal credit score, income, and banking relationship

- No tax returns or revenue documentation required

- Introductory offers often include 0% interest for 9–18 months

This structure allows banks to approve new, non-revenue LLCs with surprisingly high limits.

Key Benefits of This Type of Business Funding

Business credit cards for new LLCs offer several advantages that traditional loans do not.

Main Benefits

- Up to $50,000 in funding

- 0% APR introductory periods

- No proof of income or revenue

- Same-day or instant approval

- Flexible use of funds

- Build business credit profile

- No collateral or zero down

Because these offers are unsecured, they are ideal for startups, online businesses, consultants, and service providers.

Who Can Apply for $50,000 Business Funding

This type of funding is best suited for individuals who meet specific personal credit criteria.

Eligible Applicants

- New LLC owners (even 0–30 days old)

- Entrepreneurs with good to excellent credit

- Freelancers and consultants forming an LLC

- Online businesses and startups

- First-time business owners

If your personal credit is strong, business age becomes far less relevant.

Requirements and Documents Needed

Although no income proof is required, banks still expect a basic foundation.

Minimum Requirements

- Personal credit score 680+ (700+ preferred)

- Active LLC with EIN

- U.S. address and phone number

- Business checking account (recommended)

- Personal income disclosure (stated income)

Documents Typically NOT Required

- No tax returns

- No profit & loss statements

- No bank statements

- No revenue verification

In most cases, approval is based on creditworthiness, not business performance.

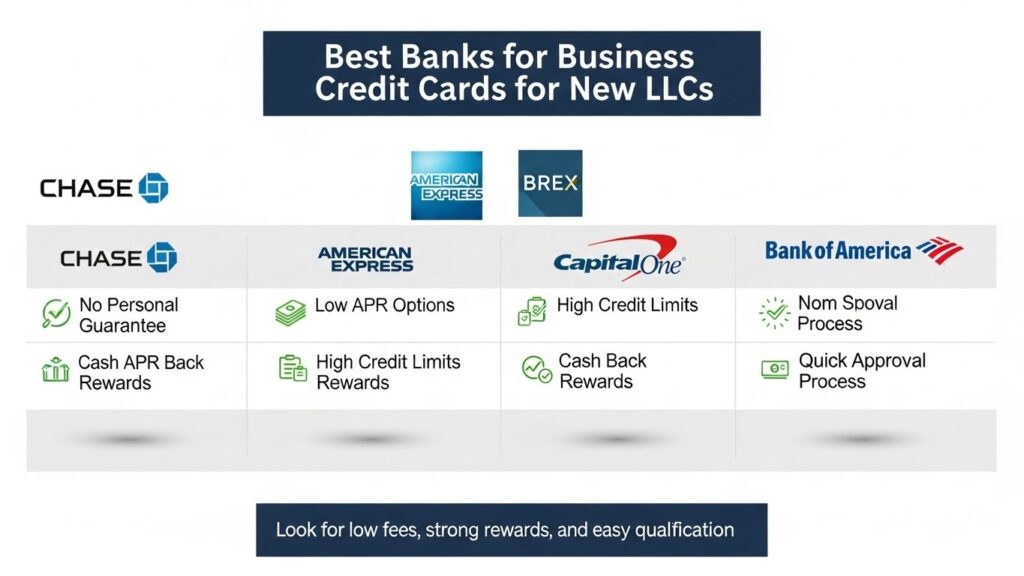

The 7 Best Banks That Approve a New LLC for $50,000

Below are the top lenders most likely to approve a brand-new LLC with high limits and favorable terms.

1. Bank of America

Bank of America offers multiple business credit cards with 0% APR for up to 9 billing cycles.

Why it works well for new LLCs:

- Up to 3 business cards approved

- High credit limits with relationship banking

- Often pulls Experian or TransUnion

Best Strategy:

Open a business checking account, deposit at least $500, and apply sequentially.

2. Chase Bank

Chase is one of the strongest options for high-limit business credit.

Key Advantages:

- 0% APR for 12 months

- Two business cards within 30 days

- EIN-based and SSN-based approvals possible

Important Rule:

Chase follows the 5/24 rule for personal cards, but business cards do not count once approved.

3. U.S. Bank

U.S. Bank offers some of the longest 0% APR periods available.

Highlights:

- 0% interest up to 18 billing cycles

- Strong relationship-based approvals

- Often pulls TransUnion

Opening a business checking account significantly increases approval odds.

4. Goldman Sachs (Marcus)

Marcus offers a hidden-gem business card with pre-approval.

Why It Stands Out:

- No hard inquiry before acceptance

- 0% APR for 12 months

- $750 bonus after qualifying spend

Ideal for those unsure about their credit profile.

5. American Express

American Express is extremely generous once you’re in.

Benefits:

- High credit limits

- Apply with Confidence (soft pull)

- Potential 3× credit limit increases in 90 days

Best for applicants with at least one year of credit history.

6. PNC Bank

PNC is excellent for balance transfers and flexibility.

Features:

- 0% intro APR on balance transfers

- Relationship banking improves limits

- Requires business checking account

Often pulls Experian.

7. Truist

Truist has one of the lowest credit score entry points.

Why It’s Unique:

- Approvals starting at 620–650 credit

- Bankruptcy-friendly (4+ years discharged)

- Multiple approvals in a short timeframe

Ideal for applicants rebuilding credit.

Comparison of the Top Banks

| Bank | 0% APR Period | Credit Score | Max Potential |

|---|---|---|---|

| Bank of America | 9 months | 680+ | $50,000 |

| Chase | 12 months | 680+ | $50,000 |

| U.S. Bank | 18 months | 700+ | $50,000 |

| Goldman Sachs | 12 months | 680+ | $50,000 |

| American Express | Varies | 700+ | $50,000+ |

| PNC | Transfer focus | 680+ | $30,000+ |

| Truist | 9–12 months | 620+ | $30,000+ |

Rates, Interest, and Repayment Terms

- Intro APR: 0% for 9–18 months

- Post-Intro Rates: Variable (typically 17%–29%)

- Fees: Many cards have no annual fee

- Funding Speed: Same day to 7 days

Using the 0% period strategically can save thousands in interest.

Practical Tips to Get Approved Faster

Proven Approval Strategies

- Form an LLC with a neutral, low-risk name

- Avoid industries like gambling, cannabis, credit repair

- Open business checking accounts first

- Apply in-branch when possible

- Use realistic projected revenue, not zero

- Call reconsideration lines after denial

Planning is the difference between a $5,000 limit and a $50,000 limit.

Frequently Asked Questions (FAQ)

Can I get approved with no revenue?

Yes. Most approvals are based on personal credit, not business income.

Is this a no credit check loan?

No. A personal credit check is required, but no business credit history is needed.

Can bad credit qualify?

Applicants with bad credit have lower odds, but options like Truist may work.

How fast is approval?

Many banks offer instant approval or same-day decisions.

Does this build business credit?

Yes. Responsible use helps establish strong business credit profiles.

Get Funded Before You Need It

Choosing among the 7 Banks That Approve a New LLC gives startups a strategic advantage to secure funding early, reduce risk, and scale faster in the U.S. market.

The smartest business owners secure funding before cash flow becomes a problem. These 7 banks that approve a new LLC for $50,000 with no proof of income give you a rare opportunity to build leverage, stability, and growth capacity from day one.

If you’re serious about scaling your business, now is the time to compare options, build relationships, and secure funding while approval odds are highest.

Continue exploring our site to compare lenders, learn approval strategies, and unlock the best business funding options available in the U.S. today.