Best Personal Loans for ITIN Holders with instant approval, low interest rates, and high approval odds. Compare top online lenders and apply today.

Why ITIN Holders Are Finally Getting Approved

Finding a personal loan in the United States without a Social Security Number used to be nearly impossible. For millions of immigrants, freelancers, international workers, and non-resident taxpayers, traditional banks simply said “no.”

Today, that reality has changed.

Thanks to online lenders, fintech innovation, and credit unions adapting to a diverse economy, ITIN holders can now access personal loans with competitive rates, same-day funding, and high approval odds—even with limited or bad credit.

This guide reveals the best personal loans for ITIN holders, explains how they work, compares top lenders, and provides proven strategies to get approved faster while securing the lowest interest possible.

What Are Personal Loans for ITIN Holders and How Do They Work?

A personal loan for ITIN holders is an unsecured or secured loan offered to individuals who file taxes using an Individual Taxpayer Identification Number (ITIN) instead of an SSN.

These loans work similarly to standard personal loans:

- Fixed loan amounts

- Fixed or variable interest rates

- Monthly installment payments

- Terms typically ranging from 12 to 60 months

The main difference lies in how lenders evaluate risk. Instead of relying solely on an SSN-based credit profile, lenders assess alternative data such as:

- ITIN-based credit reports

- Income consistency

- Banking history

- Employment stability

Many lenders now offer online applications, instant approval decisions, and same-day funding, making the process faster than ever.

Key Benefits of Personal Loans for ITIN Holders

Access to U.S. Credit Without an SSN

ITIN loans allow immigrants and non-citizens to build a legitimate U.S. credit profile over time.

High Approval Odds Compared to Traditional Banks

Fintech lenders and credit unions often approve applicants rejected by big banks.

Competitive Interest Rates

Rates can be surprisingly low, especially for borrowers with stable income and clean payment history.

Flexible Use of Funds

Use the money for emergencies, debt consolidation, medical bills, education, or starting a small business.

Same-Day or Next-Day Funding

Many online lenders disburse funds within 24 hours.

Who Can Apply for a Personal Loan With an ITIN?

You may qualify if you are:

- A non-U.S. citizen filing taxes with an ITIN

- An immigrant without permanent residency

- A freelancer or independent contractor

- An international worker or student with U.S. income

- A mixed-status household member

Most lenders do not require citizenship or permanent residency, only proof of legal income and identity.

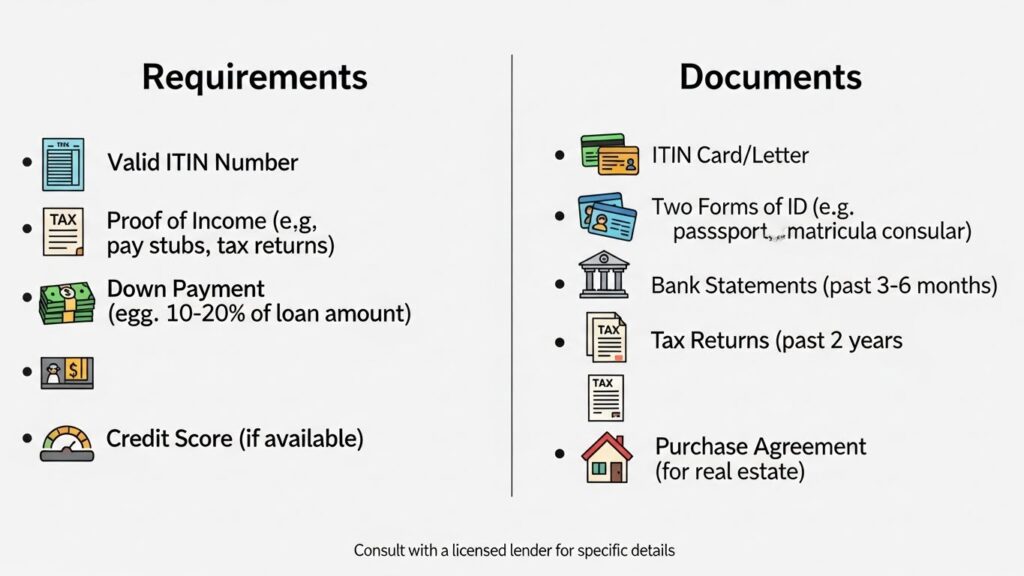

Requirements and Documents Needed

While requirements vary by lender, most ITIN personal loans require:

Basic Requirements

- Valid ITIN number

- U.S. address

- Active U.S. bank account

- Minimum income (often $1,500–$2,000/month)

Required Documents

- Government-issued photo ID (passport or foreign ID)

- ITIN confirmation letter

- Proof of income (pay stubs, bank statements, tax returns)

- Utility bill or lease agreement

Some lenders may approve without a traditional credit check, relying on income and banking data instead.

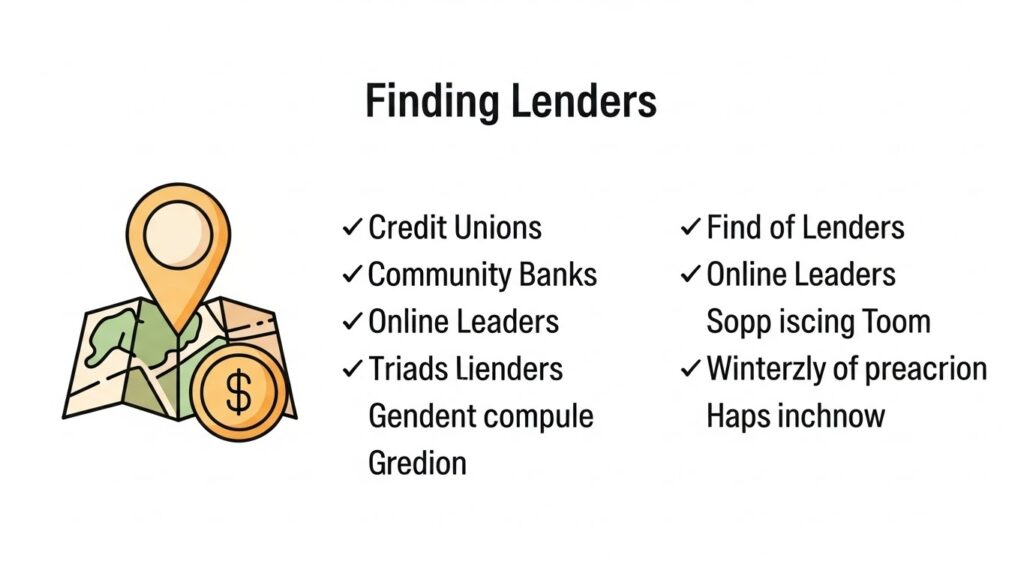

Best Banks and Online Lenders for ITIN Holders

Credit Unions

Credit unions are often the best option for ITIN holders due to lower rates and flexible underwriting.

Advantages:

- Low interest rates

- Relationship-based approval

- Higher loan limits

Online Lenders

Online lenders specialize in non-traditional borrowers.

Advantages:

- Instant approval decisions

- Same-day funding

- Bad credit acceptance

Community & Regional Banks

Some regional banks actively support ITIN lending programs, especially in immigrant-dense areas.

Comparing ITIN Personal Loan Options

| Feature | Credit Unions | Online Lenders | Traditional Banks |

|---|---|---|---|

| ITIN Accepted | Yes | Yes | Rare |

| Approval Speed | Medium | Instant | Slow |

| Interest Rates | Low | Medium | Low |

| Credit Flexibility | High | Very High | Low |

| Same-Day Funding | Rare | Common | No |

For most ITIN holders, online lenders or credit unions provide the highest approval odds.

Interest Rates, Fees, and Loan Terms

Typical Interest Rates

- Excellent profile: 6%–10% APR

- Average credit: 10%–20% APR

- Bad credit: 20%–36% APR

Loan Amounts

- Minimum: $1,000

- Maximum: $50,000 (varies by lender)

Repayment Terms

- 12 to 60 months

- Fixed monthly payments

Fees to Watch

- Origination fees (0%–8%)

- Late payment penalties

- Prepayment fees (rare but possible)

Always compare the APR, not just the interest rate.

Practical Tips to Get Approved Faster

Open a U.S. Bank Account

Lenders strongly prefer applicants with established banking history.

File Taxes Consistently Using Your ITIN

Tax returns build credibility and income verification.

Apply With Online Lenders First

They have more flexible approval models.

Avoid Multiple Hard Credit Checks

Use lenders offering soft credit checks during prequalification.

Consider a Co-Signer (If Available)

Some lenders allow ITIN co-signers, improving approval chances and rates.

Frequently Asked Questions (FAQ)

Can I get a personal loan with only an ITIN?

Yes. Many lenders approve loans using an ITIN instead of an SSN.

Do ITIN loans require a credit score?

Not always. Some lenders approve based on income and banking data.

Can I get instant approval?

Yes. Many online lenders provide instant approval decisions.

Are interest rates higher for ITIN holders?

Not necessarily. Strong income and history can secure competitive rates.

Can I use the loan for any purpose?

Yes. Most personal loans have no usage restrictions.

Compare and Apply With Confidence

Access to credit is no longer limited to those with an SSN. Today, ITIN holders can secure personal loans with fair rates, fast approval, and real financial flexibility.

The key is choosing the right lender, preparing your documents, and comparing offers carefully.

If you are ready to take the next step, continue exploring trusted lenders, compare rates, and apply with confidence. The right personal loan can help you stabilize finances, build credit, and unlock new opportunities in the United States.

Start comparing your options now and find the best personal loan for ITIN holders today.